Repay Your Credit score Playing cards

We now have all the time been actually good with bank cards.

Holding a stability on a card stresses me out, so I pay it off each month earlier than the due date.

Do not throw cash away by paying curiosity on bank cards.

If you cannot afford it, do not buy it.

However that does not imply we do not use our bank cards. We really put every part on bank card.

It’s the best option to observe bills. You possibly can verify your assertion every month and see the place your cash goes.

And it’s the simplest way to save cash for journey.

Get a Rewards Credit score Card

Some of the costly up-front prices for long run journey is your flights.

That is the place a journey rewards bank card will turn out to be useful. However as I mentioned above, provided that you pay it off every month and are diligent about not spending greater than you want.

You would be amazed how rapidly you possibly can earn factors once you purchase issues like groceries, toiletries, and even remedy in your bank card.

Rewards add up quick.

With a journey rewards card, you additionally get a sign-up bonus. Simply by signing up, you could possibly get some huge cash in direction of a flight.

We use American Categorical more often than not, however our TD Journey Visa would not have a charge and it has nice journey advantages too.

Do a little analysis to see what card is greatest for you. What card presents the flight rewards you need.

The Factors Man is a good useful resource that can assist you select the best card.

Our Amex presents journey rewards. We make purchases all yr on it and we get rewards with every one.

We normally have wherever from $800 – $1000 in direction of journey by the top of every yr. We buy a ticket after which give Amex a name and ask them to pay it off with our rewards. (if we’ve sufficient – which we normally do as a result of we put all bills on it)

Chase Sapphire is widespread in america and we hear it’s even higher than Amex.

again to prime

Change Your Dwelling State of affairs

When you have a home, however you might have a dream to journey, it’s possible you’ll need to promote it.

That is what we did. We knew we weren’t comfortable as householders, so we put it up on the market.

I bear in mind the time that we owned that home was probably the most nerve-racking time of our lives. We have been all the time anxious about cash and what we’d do if the following film contract did not are available in.

We felt trapped and puzzled if this was going to be the place we have been caught for the remainder of our lives.

Should you do not need to promote your own home, it’s possible you’ll simply need to begin on the lookout for a subletter to lease your home for a yr or so.

I do know those who have sublet their home whereas constructing fairness and journey full time. They lease somewhere else as an alternative of shifting again house and are completely comfortable.

In case you are at present renting, it’s possible you’ll need to transfer to a smaller place in a less expensive neighborhood.

Consider any option to reduce prices. It is a comparatively simple manner to save cash when you have bigger belongings like this.

again to prime

Promote Your Issues

We had a storage sale to eliminate all of the stuff we had purchased over the previous few years.

We made a few thousand bucks on our storage sale in the event you can imagine it.

We bought every part from garden mowers, to our Physician Ho massager and even a knife (that we did not’ understand was price a lot) however a man provided us $50 for it!

Folks have been giving us 20 bucks for glassware units and knick-knacks. We had a lot muddle. And it felt wonderful as soon as it was all gone.

Even in the event you do not need to promote your own home, having a storage sale will make you some additional money whereas lifting the burden of all that additional muddle.

We did so nicely on the storage sale, we began on the lookout for extra issues to promote.

We bought diving gear, we bought a guitar, we bought Dave’s drums. We simply stored on discovering issues to promote!

All of it added as much as a fairly penny that went into our journey fund and reduce our month-to-month deposits to our journey fund in half.

Take into consideration what you might have that you do not want, however another person would like to have!

again to prime

Way of life Change and Mindset

Once you want cash to journey, one of the crucial apparent locations to take a look at is your way of life. By altering just a few habits you possibly can put away extra cash in direction of your subsequent journey.

We owned two automobiles that we have been paying month-to-month funds on. Once we went down to at least one automotive, we bought the newer one and paid off the opposite.

Now we did not have automotive funds and since the automotive we have been driving was older, we canceled the collision insurance coverage on it.

It wasn’t price a lot, so we solely made certain to have legal responsibility insurance coverage if we bought in an accident.

That reduce our insurance coverage charge by a whole bunch. Now with no automotive funds and fewer insurance coverage, we have been spending so much much less on automotive bills.

Plus, by residing within the metropolis, we paid much less fuel and will trip our bikes or stroll to wherever we needed.

again to prime

Consuming Out

This was a tricky one for us. We cherished consuming out, it was our time to speak and catch up.

However as soon as we began consuming at house extra, we saved much more cash.

If I might inform my 23-year-old self to be taught to prepare dinner at house, I’d have saved myself some huge cash complications.

We made cooking an occasion and acquired solely contemporary substances in bulk.

Once we did have wine or beer, we went for a budget stuff.

Sure, we purchased boxed wine and Labatt’s beer.

Fortunately, we have been so busy with life, we did not a lot in any respect whereas saving for our travels.

We had a purpose in thoughts and when eager about placing $40 in direction of alcohol or our journey fund, the fund normally gained out.

And we invested in a great espresso maker so we did not need to go to Starbucks every time we wanted our caffeine repair.

I all the time known as Starbucks 4-bucks. 4 bucks a pop, for a espresso, that provides up quick!

Leisure

We used to satisfy pals on the bar or nightclub and lay our a fortune on drinks and meals.

As our way of life modified, we began to go over to pals homes and have them over to ours.

We nonetheless had a social life, however we weren’t throwing cash away downtown and we have been saving cash in direction of our purpose.

Hobbies

Once we had our home, our hobbies have been fairly costly. We had a ski go at Blue Mountain and infrequently stayed over on the resort after consuming out on the restaurant.

We additionally did a variety of scuba diving journeys in the summertime across the Nice Lakes and St. Lawrence River staying in lodges every weekend.

again to prime

Discover Free Issues to Do

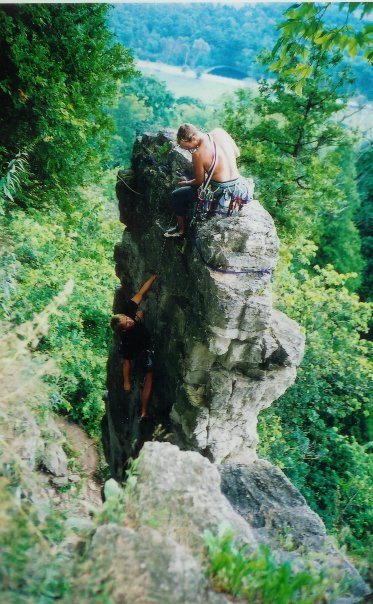

Once we moved downtown, we bought extra into mountaineering. Our one splurge was our mountaineering health club membership, and we principally grew to become health club rats. We cherished climbing and have been there almost each night time in the course of the week!

As a substitute of spending a ton of cash every weekend, we went tenting close to the crag after which went mountaineering without cost.

We ended up doing a variety of enjoyable free issues like mountain biking, assembly up with the biking membership for night rides, going climbing or heading out to Niagara Glen or the Bruce Path for some mountaineering.

We have been busy and adventurous and did not spend a a lot on something aside from snacks and perhaps a park entry charge.

Assume Constructive

I do know it looks like so much, however it may be performed.

Should you take issues one step at a time and comply with our suggestions for saving cash, you possibly can obtain your purpose of touring the world.

Make a listing, take inventory of your bills, debt, and revenue and work out what that you must do to comply with your dream.

For us, it was overwhelming to do all of these items earlier than we left, however as soon as we have been on the highway, we have been free to get pleasure from our travels as a result of we did not have any worries at house.

And we’ve by no means missed all that stuff we gave up. Since we began a lifetime of journey, we have loved the liberty of not having muddle in our lives and debt in our financial institution accounts.

Remaining Thought

Dave and I discovered that every time we took an opportunity and made room for our goals, nice issues occurred. In case you are not comfortable the place you might be, begin pondering in another way and make that change.

The very best journeys begin with step one.